Year-End Procurement Insights: What Global Buyers Look for in 2025

As businesses wrap up the year and prepare for new operational targets, the year-end procurement season has become one of the most important windows for upgrading digital devices. For many global buyers—whether in education, retail, or industrial applications—this period offers budget advantages, faster delivery cycles, and clearer planning visibility for the coming year.

Below, we break down the key trends shaping 2025 year-end procurement and provide practical guidance for selecting the right Android AIO devices, POS tablets, and industrial displays.

1. Why Year-End Procurement Matters in 2025

Recent B2B purchase data from global distributors shows that more than 35% of annual device upgrades are executed between Q4 and early Q1. This shift is driven by several factors:

-

Leftover annual budgets push organizations to complete device upgrades before closing their fiscal year.

-

New project rollouts in education, retail digitalization, and factory automation often begin in January.

-

Cycle-based replacement: Many enterprises follow a 3–4-year hardware renewal cycle, which often aligns with year-end planning.

In 2025, demand for Android-based AIO terminals, POS systems, and industrial touch displays remains strong due to their flexible deployment, lower total cost of ownership (TCO), and customizable software environment.

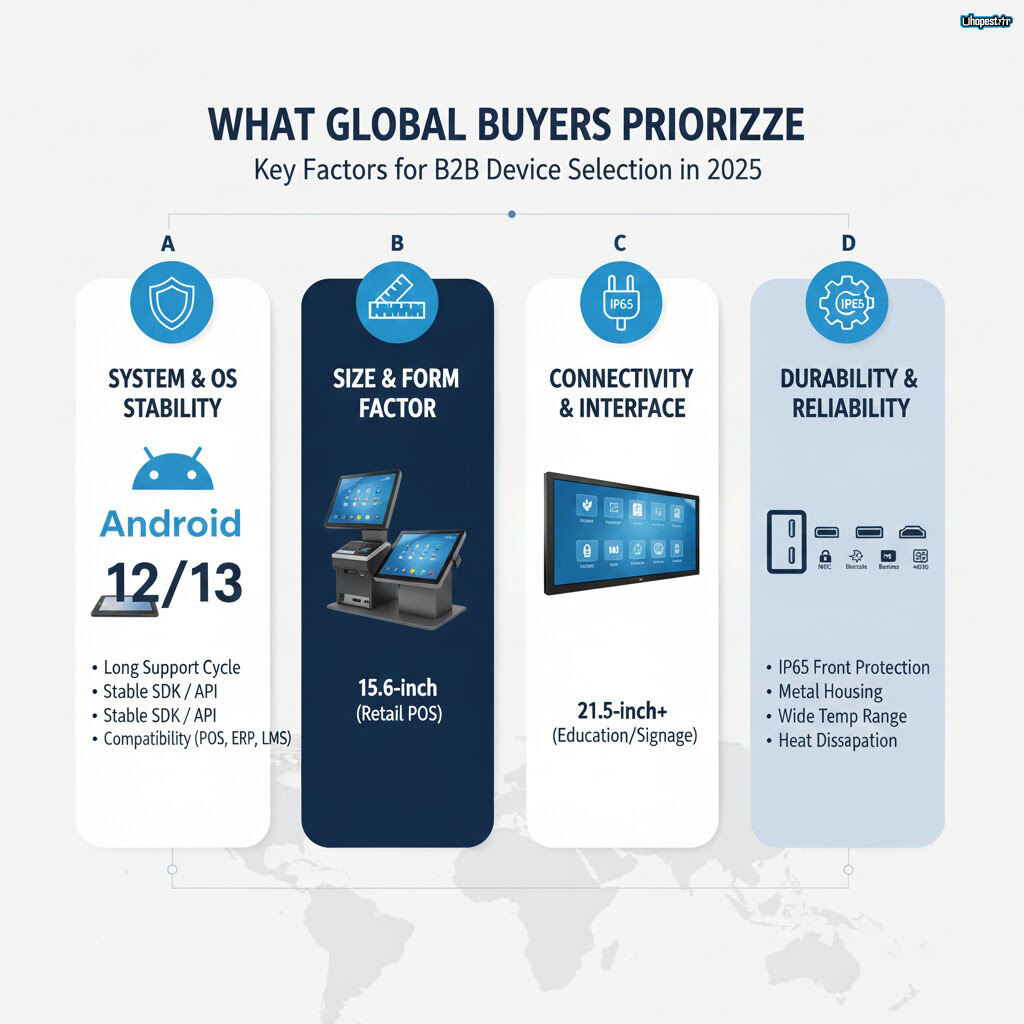

2. What Global Buyers Prioritize When Choosing Devices

A. System & OS Stability

International buyers increasingly prefer Android 12/13 platforms with long-term support. Stability, security patches, and compatibility with enterprise applications are now core decision factors.

What they look for:

-

Long support cycle

-

Stable SDK / API documentation

-

Compatibility with POS, ERP, LMS, kiosk software

B. Size & Form Factor Variety

Device size selection becomes scenario-driven:

-

10.1-inch remains the mainstream choice for handheld industrial terminals and kiosks.

-

15.6-inch becomes the hot spot in retail POS due to dual-screen potential and wider visibility.

-

21.5-inch and above continue to grow in education and digital signage projects.

C. Connectivity & Interface Options

For B2B projects, flexibility still wins.

Buyers prefer products with:

-

Multiple USB ports

-

RS232 / GPIO for industrial integration

-

Type-C for fast data/power

-

Optional NFC, barcode scanning, or 4G/5G

D. .

Especially for industrial and education customers, device durability can directly impact maintenance cost.

Most requested features:

-

IP-rated protection (IP65 front for industrial displays)

-

Metal housing or reinforced structure

-

Wider operating temperature ranges

-

Strong heat dissipation design

3. Recommended Product Solutions for 2025 Year-End Procurement

1. RK3568 Android Tablet Series

Ideal for education, kiosks, and public service terminals.

-

Android 12/13 options

-

Rich SDK for easy customization

-

Stable performance with long-term availability

-

Sizes from 10.1 to 21.5 inches

2. 15.6-inch Android POS Terminal

Designed for modern retail and F&B.

-

Dual-screen support

-

Multiple USB and RJ45 ports

-

Optional NFC, scanner, or MSR

-

Slim and stable structure for 24/7 operation

3. 10.1-inch Industrial Touch Panel

Suitable for factories, automation lines, logistics equipment.

-

IP65 front protection

-

Wide operating temperatures

-

RS232 / GPIO for equipment integration

-

Metal housing with strong heat dissipation

4. Final Thoughts: How to Plan Your 2025 Year-End Procurement

To secure stable supply and avoid delays, global buyers should:

-

Confirm OS version and long-term support (LTS)

-

Evaluate interface requirements based on project scenarios

-

Choose durable materials and IP standards for long-term reliability

-

Ensure vendor support for customization, branding, or pre-installed apps

For system integrators and distributors, year-end procurement is also an opportunity to lock in competitive pricing and secure stock ahead of Q1 demand peaks.